tax benefit rules for trusts

However the tax rules can help with this. The tax benefits of trusts vary from one country to another but often include some sort of tax exemptions that make it possible for the beneficiary to avoid paying inheritance.

As A Trust Beneficiary Am I Required To Pay Taxes Legacy Design Strategies An Estate And Business Planning Law Firm

Reverts back to up to 2000 for 2022 2025.

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)

. 2 days agoThe Rules shall be applicable on pension income derived on or after 1 January 2022 by an individual who is at least sixty-one 61 years old in the year in which the pension income. So for example if a trust earns 10000 in income during. These tax levels also apply to all income generated by estates.

Find out more by reading the information on. The Tennessee Community Property Trust Act TCPTA of 2010 Tennessee Code Annotated Section 35-17-101 et seq allows married couples to convert their individual assets into. In some cases a grantor trust will have to file a return on Form 1041 but the only entry will be a statement saying that all income was carried out to the grantors tax return.

The tax benefit rule has been developed by court decisions statutes and revenue rulings. 6 hours agoFor couples who have joined their rates they would benefit from 924600 instead of 650000 at the current limit. All of the tax rules for hiring employees apply to resident managers but there are a couple of special rules you need to know about.

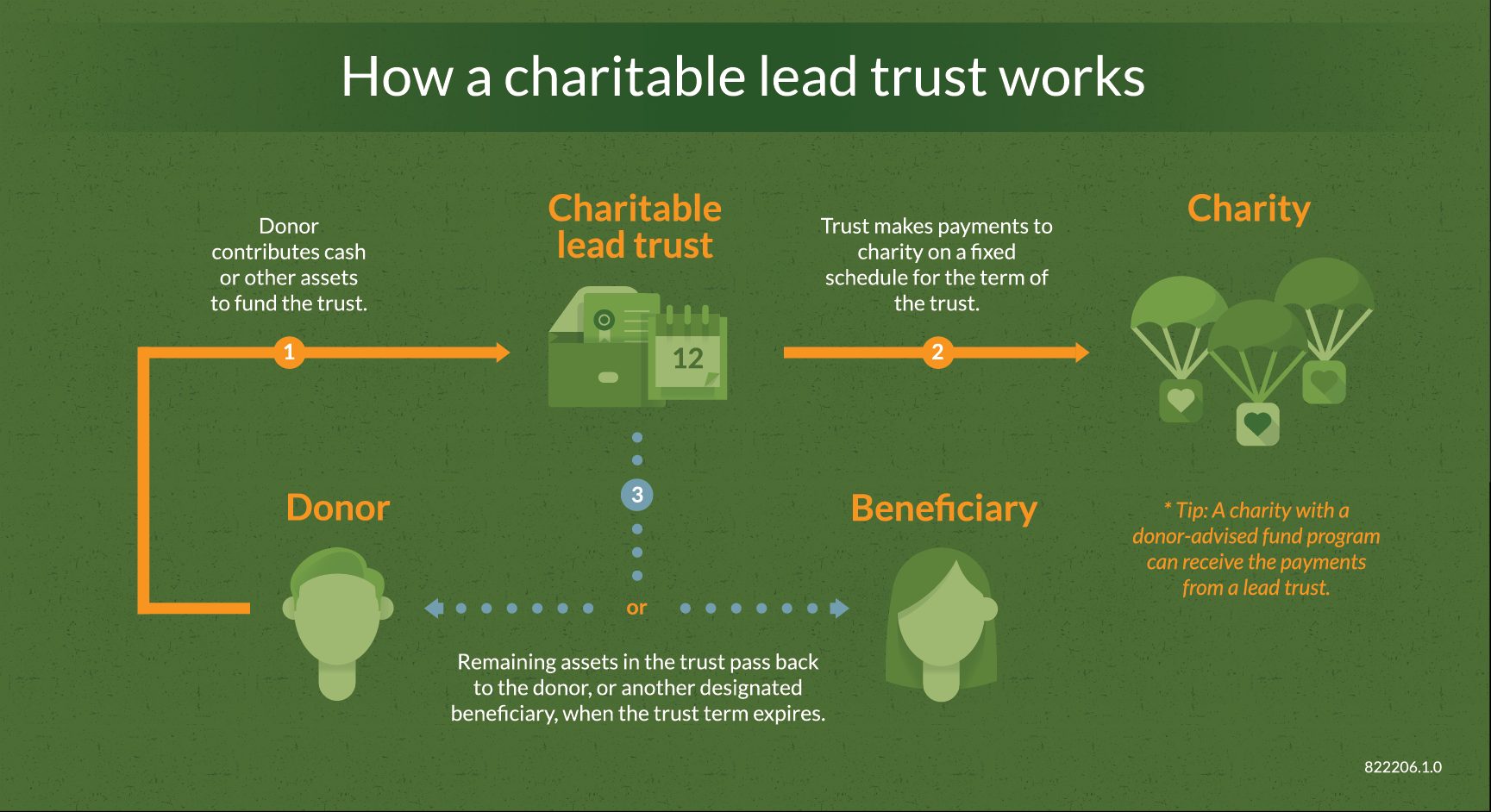

16 2010 the Internal Revenue Service IRS issued Revenue Ruling 2011-1 which modifies the. Rather than selling an asset. Capital gains tax benefits of trusts.

Discussion of federal tax rules that apply to non-exempt charitable trusts under Code section 4947a1. Sometimes the settlor can also benefit from the assets in a trust - this is called a settlor-interested trust and has special tax rules. The benefit of the deductions for amortization provided by sections 169 and 197 shall be allowed to estates and trusts in the same manner as in the case of an individual.

One potential issue with creating a trust is having the cash resources to make a gift. Income tax in 2018 Bs state and local tax deduction would have remained the same 10000 and Bs itemized deductions would have remained the same 15000. Excepted Group Life Trusts to remain subject to inheritance tax rules.

1 day agoFor tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows. B received no tax. If a trust was limited to a 10000 state tax deduction in 2018 why should it then report the.

Taxpayers would also be able to completely exempt much. Perry created a trust fund to be used to construct an addition to the public library. Why doesnt the 1041 program consider the tax benefit rule for state tax refunds.

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. IRS Expands Rules for Tax-Exempt Group Trusts.

A charitable trust described in Internal Revenue Code section. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable. The standard rules apply to these four tax brackets.

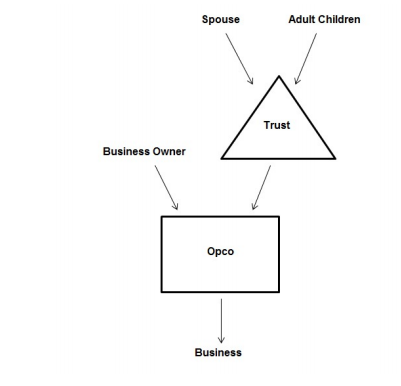

Many estate plans that utilize Jointy.

How To Avoid Estate Taxes With Trusts

Income Tax Accounting For Trusts And Estates

Unexpected Tax Bills For Simple Trusts After Tax Reform

Trust Situs Benefits For Trustees And Fiduciaries

Reverse Morris Trust Definition Example How It Works

Income Tax Accounting For Trusts And Estates

Using Trusts To Shift Income To Children

Canada S New Income Splitting Tax Rules And Family Trusts Lexology

Managing A Special Needs Trust A Guide For Trustees 2020 Barbara Jackins Richard S Blank Ken W Shulman 9780998814216 Amazon Com Books

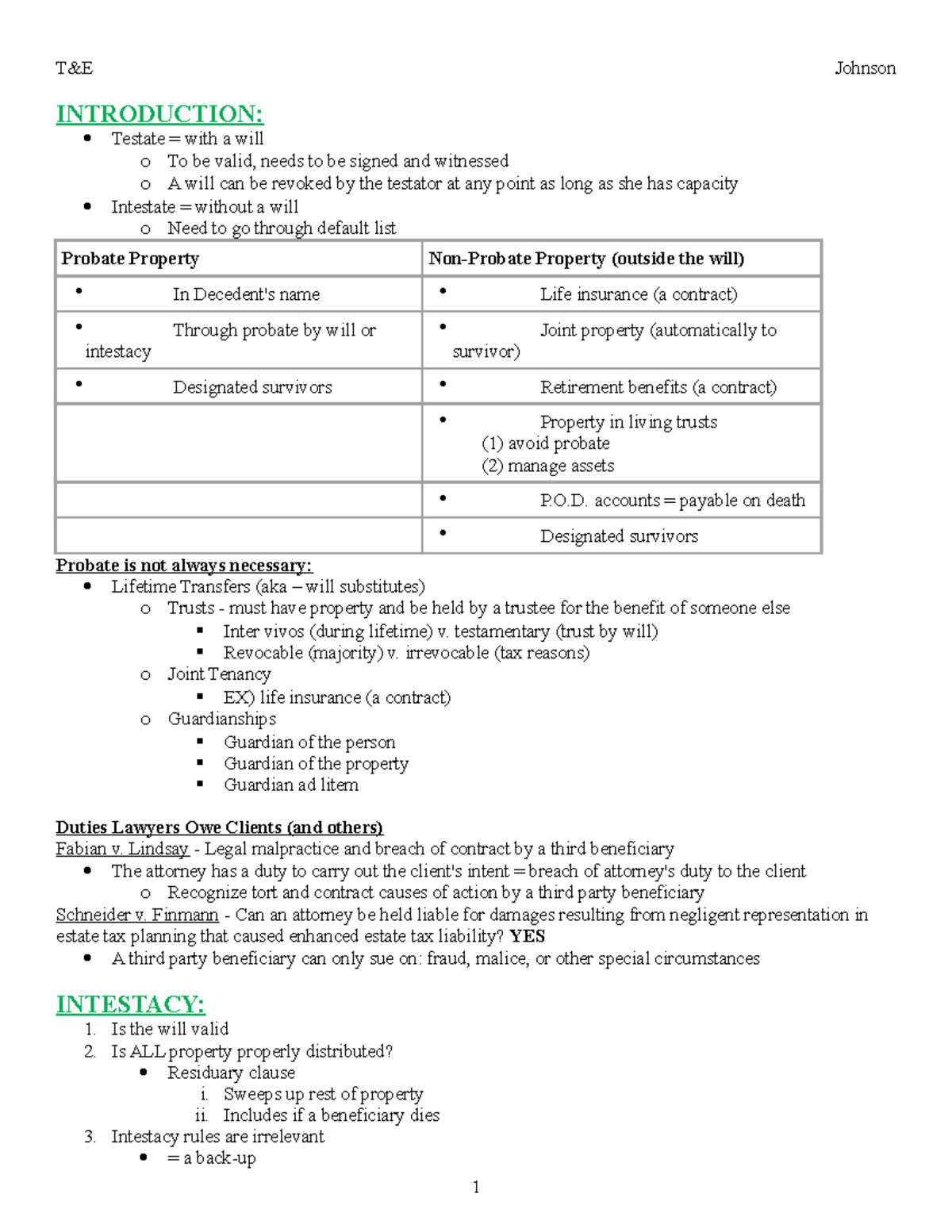

T E Pratt Outline Introduction Testate With A Will O To Be Valid Needs To Be Signed And Studocu

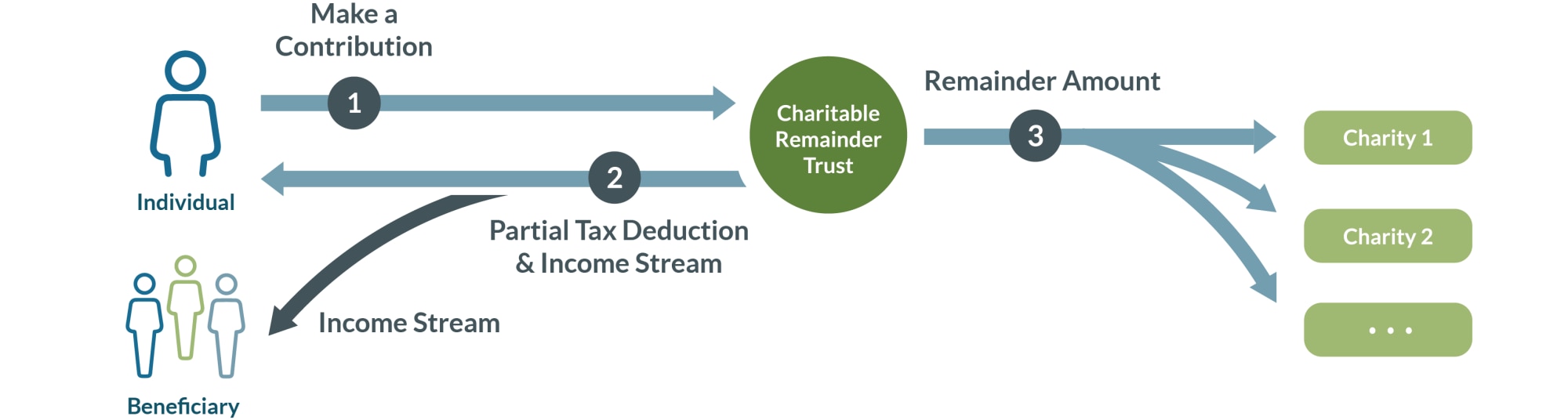

Charitable Remainder Trusts Fidelity Charitable

4 Unintended Consequences Of Congressional Proposals To Change Ira Investment Rules Millennium Trust Company

The Future Of Testamentary Trusts For You Your Children And Their Children Lexology

How Are Trusts Taxed American Academy Of Estate Planning Attorneys

Tax Advantages For Donor Advised Funds Nptrust

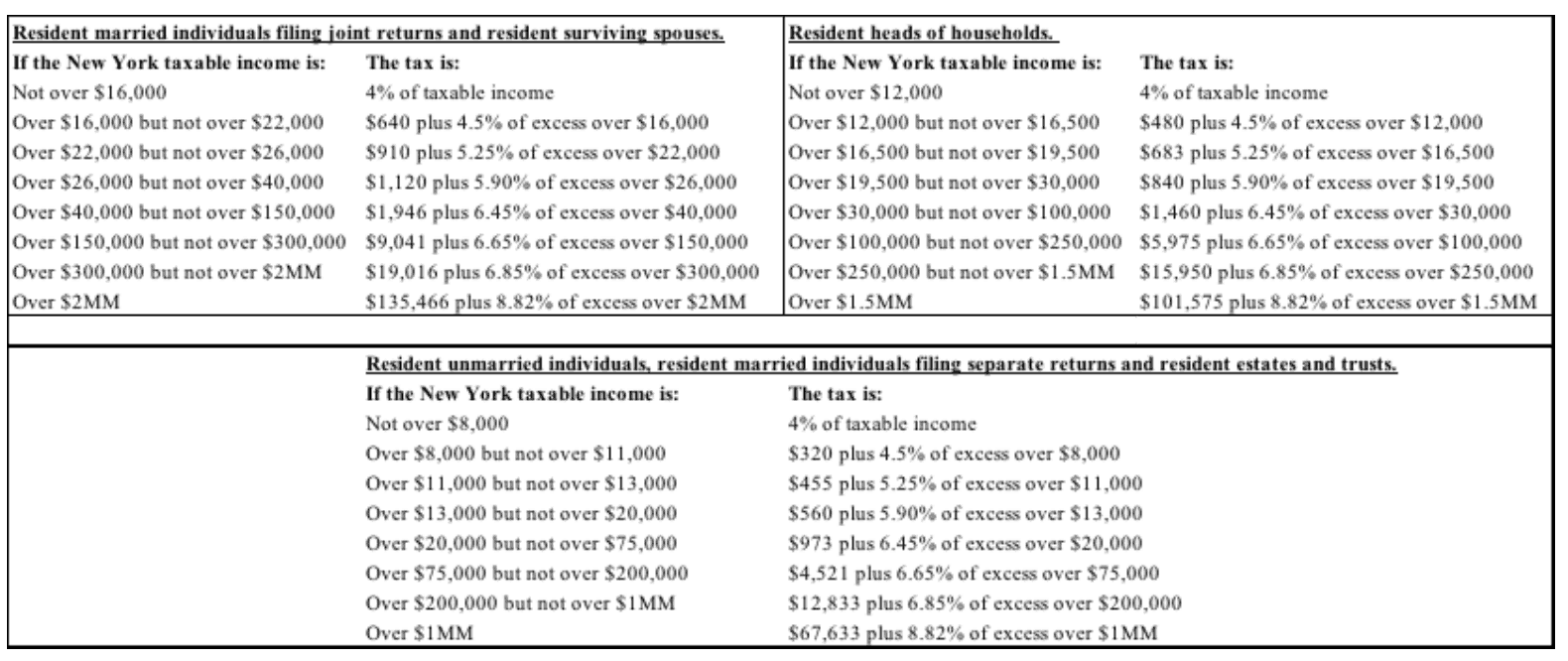

New York Resident Trust Vs An Individual Tax Rate